pay utah property tax online

Otherwise you can contact. Real Property Tax numbers are in the following format.

Clark County Indiana Treasurer S Office

Do not staple your check to your return.

. To pay Real Property Taxes. What you need to pay online. Do not mail cash with your return.

1 of the payment amount with a minimum fee of 100. If you are mailing a check or money order please write in your account number and filing period or use a. Write your daytime phone number and 2021 TC-40 on your check.

Based On Circumstances You May Already Qualify For Tax Relief. Be Postmarked on or before November 30 2022 by the United. Remove any check stub before sending.

In Utah residential property is exempt from. For your protection do not send cash through the mail. Ad We Help Taxpayers Get Relief From IRS Back Taxes.

Online payments do not. Salt Lake County personal property taxes must be paid on or before the deadline for timely payment shown on the tax notice or interest will begin to accrue. 7703 or by sending in form TC-804B Business Tax.

This web site allows you to pay your Utah County real property taxes online using credit cards debit cards or electronic checks. Payments must be postmarked by. Your property serial number Look up Serial Number.

Form of Payment Payment Types Accepted Online. Steps to Pay Your Property Tax. They conduct audits of personal.

Property Tax payments may be sent via the US Postal Service to the Treasurers Office. Weber County property taxes must be brought in to our office by 5 pm. Please contact us at 801-297-2200 or taxmasterutahgov for more information.

The Personal Property Team within the Property Tax Division develops depreciation schedules used by assessors in the valuation of personal property. These are the payment deadlines. Pay Property Tax Taxes are Due November 30 2021.

Youll need your 7-digit Account Number to make payment. Detailed information about filing and paying your Utah income taxes. If you have any questions about paying your property taxes online the Utah State Tax Commissions website has a handy FAQ section that can help.

On November 30 or 2. If your adjusted gross income includes income from Utah sources you must pay tax on those sources on your federal return. Online REAL Estate Property Tax Payment System.

0 Electronic check payment. You may request a pay plan for business taxes either online at taputahgov over the phone at 801-297-7703 800-662-4335 ext. -- A processing fee will be charged for all online payments paid via debit or credit card of 25 of the transaction with a.

Find Your Account Number Here. Pay over the phone by calling 801-980-3620 Option 1 for real property. This web site allows you to pay your Utah County Personal Property Taxes online using credit cards debit cards or electronic checks.

Please contact us at 801-297-2200 or taxmasterutahgov for more information.

Utah Division Of Real Estate 1031 Exchange Addendum Fill Out Sign Online Dochub

Utah Paycheck Calculator Smartasset

Utah Property Taxes Utah State Tax Commission

Welcome To Davis County Utah Website For Real Estate Taxes

Utah Sales Tax Small Business Guide Truic

How Taxes On Property Owned In Another State Work For 2022

Utah County Raises Property Taxes 67 Ke Andrews

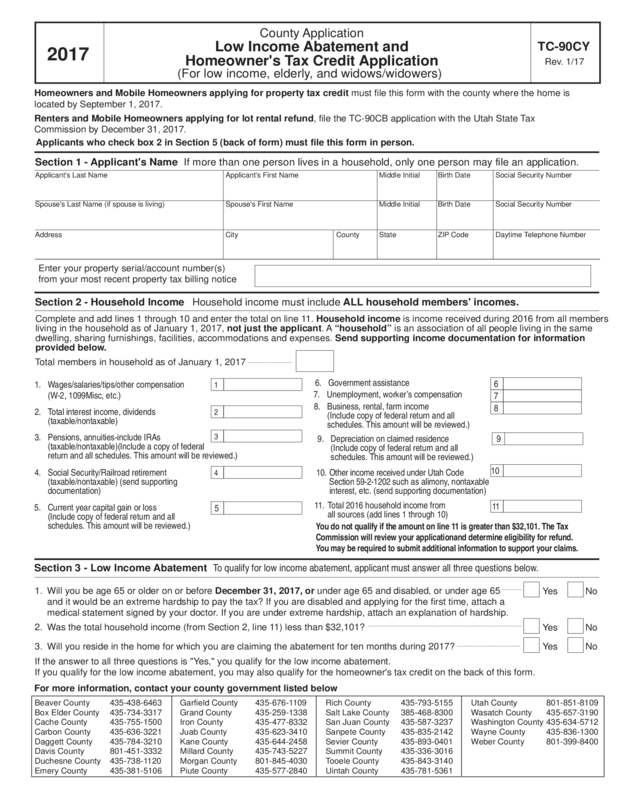

Tc 90cy Utah State Tax Commission Edit Fill Sign Online Handypdf

Property Taxes Department Of Tax And Collections County Of Santa Clara

Faqs Summit County Ut Civicengage

Tax Administration Forsyth County North Carolina

Property Taxes How Much Are They In Different States Across The Us

Utah State Tax Commission Official Website

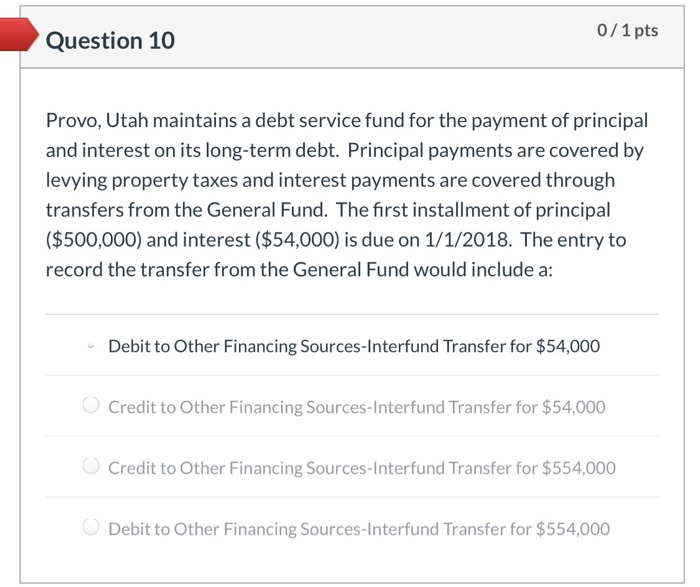

Solved Question 10 0 1 Pts Provo Utah Maintains A Debt Chegg Com