reit dividend tax malaysia

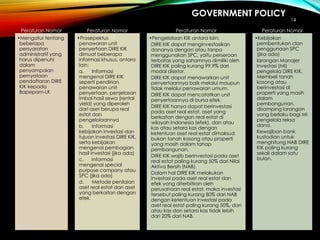

According to this regime the corporate income tax imposed on a companys profits is in the form of a final tax and the distributed dividends are exempt from tax in the hands of the shareholders. If a Malaysian REIT distributes at least 90 of its taxable income it will not be subject to corporate income tax.

Even if a REIT is exempt from tax by distributing at least 90 of its total income during the year the.

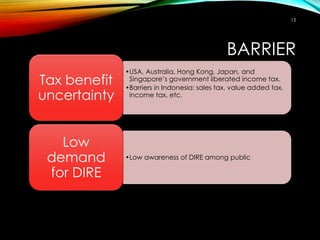

. The taxation of dividends in Malaysia is subject to a single-tier system and those dividend payments made by companies under this system are not subject to tax. AXREIT I would not buy this 5 reits now because the Dividend Yield DY are the lowest as well from 469 to 524 before deducting the 10 tax. REITs in Malaysia and around the world benefit from favorable tax treatment and typically give larger dividend yields than other corporations.

However the fund will still be taxed a Withholding Tax at 10. Retail REITs shopping malls. REIT dividends received after 31 Dec 2011 will be taxed at original 20 for foreign institutional investors and 15 for non-corporate investors including resident and non-resident inviduals.

Because of this REITs earn a higher income and investors get to earn higher yields versus physical properties. Real property gains tax is not applied to REITs property transactions. The government currently imposes a 10 withholding tax on REIT dividends to local and non-resident individual investors.

Coupled with the absence of a 25 income tax dividend payments from REITs are. One huge tax benefit of a REIT is that most income earned by it is exempted from income tax. If the 90 threshold is not met the REIT would be subjected to the prevailing corporate tax of 24.

A Real Estate Investment Trust REIT is a fund or a trust that owns and manages income-producing commercial real estate shopping complexes hospitals plantations industrial properties hotels and office blocks. 3 Do I have to pay RPGT on REITs. In a case where dividend income forms part of the total income distributed to unit holders the tax credit from tax at source is given to the REITPTF and the tax computation at REITPTF and.

2 Are REITs tax free. If a Real Estate Investment Trusts fund distributed at least 90 percent of their total yearly income to unit holders the REIT itself is exempted from tax for that year of assessment. As long as REITs in Malaysia distributes at least 90 of its current year taxable income the REIT will not be levied the 25 income tax.

Dividends are exempt in the hands of shareholders. With this tax system most Malaysian REITs if not all distributes at least 90 of its taxable income. It is hope that the reduced withholding tax of 10 will be extended if not further reduced as in NIL withholding tax in Singapore in coming Budget 2011.

This allows the REIT to distribute its income on a gross basis. REITs in Malaysia do not have to pay income tax if they distribute at least 90 of their current-year taxable income. However to enjoy this tax-free status the REIT must have most of its assets and income tied to the real estate and.

Refer to the first pictures 1. As such Malaysian REITs generally always pay out at least 90 of its. Two different important conditions affect a Malaysian REITs tax treatment.

Listed REITs in Malaysia are exempted from annual tax assessment if they distribute 90 of the years total income to unitholders. REITs tend to pay out steady incomes similar to dividends which are derived from existing rents paid by tenants who occupy the REITs properties. What about the top 5 Dividend Yield REITS.

If 90 or more of its total income is distributed to unit holders a real estate investment trust in Malaysia is exempt from income tax. However unit holders are liable to tax on the distribution of income. Hospitality REITs hotels and serviced residences.

REITPTF level-subject to tax 2000-not subject to tax REITPTF 10000 -not subject to tax REITPTF 14000 Distribution from REITPTF Distribution from REITPTF Year 2 RM Year 1 RM 3. With this tax system most Malaysian REITs if not all always distributes at least 90 of its. All REITs seeking listing on Bursa Malaysia will require Securities Commissions approval under Section.

This is a final tax and there is no need to declare this in the personal tax return of the unit holders. However in the long run she continues to prefer the retail segment particularly prime or niche malls for their proven business resilience. Is REIT Dividend Taxable In Malaysia.

Here we have highlighted the Top 10 REITs in Malaysia by market cap. REITs can distribute their. Industrial REITs warehouses logistics facilities and data centres.

The top 5 market capitalisation of REITS in Malaysia 1. Since the income distributed by REITs are tax exempt no tax credit under subsection 110 9A of the Income Tax Act ITA 1967. Dividend income Malaysia is under the single-tier tax system.

Meanwhile on Malaysian REITs still commanding attractive yields Yap says the high-yielding and Covid-19-resilient office REITS offer better interim gains via dividend yield compression. Companies are not required to deduct tax from dividends paid to shareholders and no tax credits will be available for offset against the recipients tax liability. REITs by the Capital Markets and Services Act 2007 for listing on Bursa Malaysia.

19 rows Monthly Dividends Portfolios. The first real estate investment trust was established in the United States in 1960 providing investors with the chance to participate in massive real estate holdings. REIT dividends received after 31 Dec 2011 will be taxed at original 20 for foreign institutional investors and 15 for non-corporate investors including resident and non-resident inviduals.

Market Trading Participation Statistics. It is hope that the reduced withholding tax of 10 will be extended if not further reduced as in NIL withholding tax in Singapore in coming Budget 2011. The withholding tax rate for individuals is 10.

Taxation of unit holders of REITs. REITs however are exempted from RPGT stamp duty as well as the normal 24 corporate tax rate if it distributes at least 90 of its distributable income to investors as dividends. 3 Years Continuous Growing.

In Malaysia there are mainly 5 types of REITs. This allows the REIT to distribute its income on a gross basis. Office REITs office buildings.

As long as REITs in Malaysia distributes at least 90 of its current year taxable income the REIT will not be levied the a 25 income tax.

Nav And Dpu Of Ireits In Malaysia Download Scientific Diagram

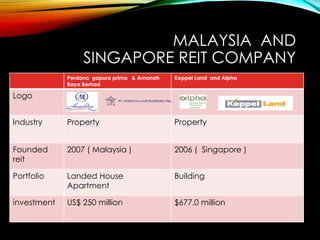

Reit Company Indo Usa Malaysia Singapore

Reits In Malaysia 8 Core Categories Of Real Estate To Invest In

Multi Management Future Solutions Malaysia Tax On Reit Investment Malaysia Starting For The Year 2009 Tax For Reit Dividend Is As Follows Also Grab The Opportunity Of Free Analysis Report

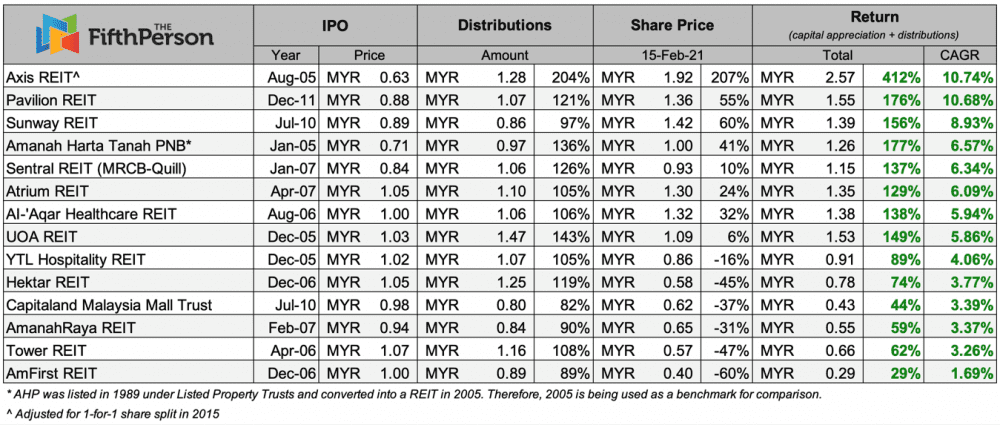

Top 5 Malaysia Reits That Made You Money If You Invested From Their Ipos Updated 2021

The Complete Guide To Reits In Malaysia Your Real Estate Partner

Reit Company Indo Usa Malaysia Singapore

Reit Company Indo Usa Malaysia Singapore

Reits A Defensive Play For Yield Hungry Investors The Star

Reit Company Indo Usa Malaysia Singapore

Reit Company Indo Usa Malaysia Singapore

Dividend Taxes Malaysia Archives Dividend Magic

Top 10 M Reits By Market Cap Rm B Source Midf 2016 Download Scientific Diagram

Top 5 Malaysia Reits That Made You Money If You Invested From Their Ipos Updated 2021

Axis Reit Archives Dividend Magic

Reit Regulatory Structure And Characteristics For Nigeria And Malaysia Download Table